Sharing Facts

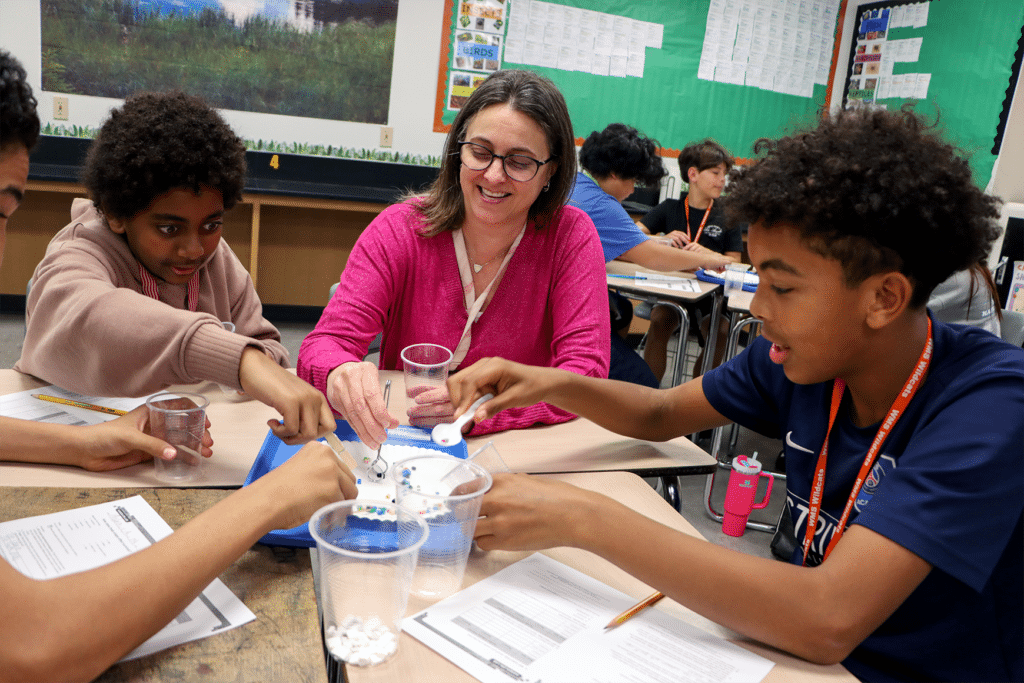

“A successful public education system is directly related to a strong, dedicated, and supportive family and … parental involvement in the school is essential for the maximum educational achievement of a child.”

– The Texas Education Code

Focused on Rockwall ISD

We recognize the financial challenges that many Rockwall families face and as a school district, we are constantly exploring ways to meet student needs without placing an undue hardship on our taxpayers. The truth is, Rockwall ISD relies on local tax collections for approximately 60% of the operating budget based on the state funding system.

The average market value in Rockwall ISD is $575,000

The average home market value of a single‐family residential property in Rockwall County in fiscal year 2024 was approximately $575,000 while the average taxable value was $386,000. This means the owner of an average home in Rockwall ISD paid $3,937 annually to support public education in 2024.

The average market value in Rockwall ISD is $575,000

The average home market value of a single‐family residential property in Rockwall County in fiscal year 2024 was approximately $575,000 while the average taxable value was $386,000. This means the owner of an average home in Rockwall ISD paid $3,937 annually to support public education in 2024.

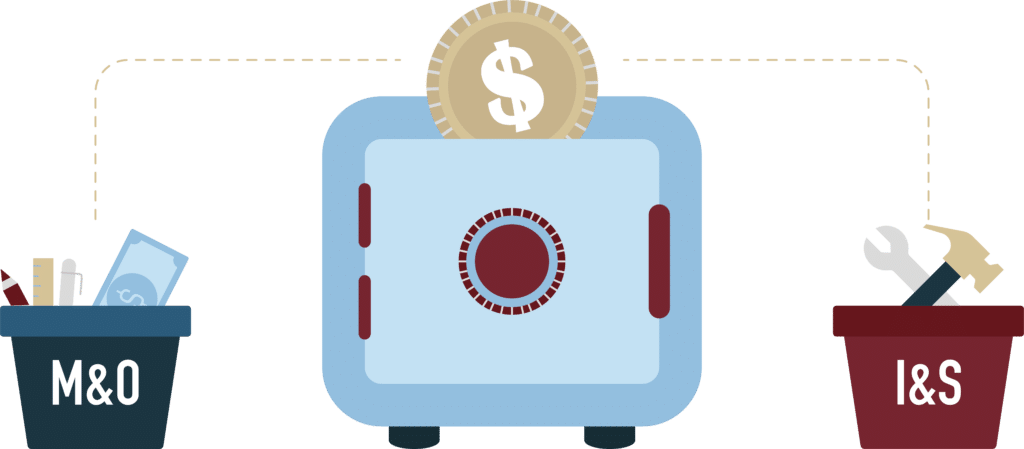

Tax Rate Breakdown

Public school tax rates are made up of two parts: Maintenance & Operations (M&O) and Interest & Sinking (I&S).

Maintenance & Operations (M&O)

The M&O rate covers daily expenses like salaries, benefits, utilities, fuel and supplies.

One way a district can generate more money for the operating side of the district’s budget is to ask taxpayers to consider a Voter-Approval Tax Ratification Election or VATRE.

Rockwall ISD is one of the only four school districts in the region where voters have not given approval of a VATRE to support the operating budget.

Interest & Sinking (I&S)

School operating budgets do not benefit from increases in local property values. In fact, state funding actually decreases when property values increase.

School operating budgets do not benefit from increases in local property values. In fact, state funding actually decreases when property values increase.

School Tax Rate Drops by More Than 44 Cents since 2016

Since 2016-2017, the Rockwall ISD tax rate has decreased more than 44 cents. As the district sold bonds for the voter-approved 2021 bond program, the I&S rate went down slightly from 2021-2022 when the Interest & Sinking tax rate was $.37 to the current year. The increase from last year to this year was $.01 overall.